We know the craft brewery business because we’ve worked closely with numerous microbreweries, brewpubs, and craft distillers to develop an insurance program that meets the unique needs of your industry.

Keeps the Goodness Flowing¶

As a craft brewer, your passion lies in using time-honoured techniques to create fresh, delicious beers for local markets. But things like equipment breakdowns and supply chain problems can interrupt production and hurt your business.

While having the right insurance coverage is essential, you want to keep your mind on your business. That’s why Palladium Insurance has created the BrewAssure program — it’s a convenient, configurable program with everything you need to protect your brewery.

Tailored to the Needs of Craft Breweries¶

Part of the advantage of Palladium Insurance is that we’re already familiar with the risks involved in craft brewery and distillery businesses.

A Full Spectrum of Coverage for Craft Breweries¶

Every brewery is unique, so you don’t have to buy coverage you don’t need. We provide flexible options to help breweries manage risks for:

- Spoilage and product recall coverage

- Liquor liability and host liability

- Supply chain insurance

- Business interruption

- Excise tax bonds

- Equipment breakdown

- Property and specialty equipment

- Copyright infringement and advertising liability

- Commercial vehicles

- Brands and labels

- Theft

- Fire

- Cyber liability

- Umbrella coverage

- General liability / slips and falls

- Disability insurance for employees

- Succession planning

- Corporate life insurance

- Critical illness insurance

- Benefits programs for employees

- Disability insurance (business overhead expense or BOE)

We also have the expertise to help you with excise tax bonds.

Convenience and Expert Guidance¶

Our insurance experts are licensed to work across Canada, and understand the unique nature of craft brewery businesses. We:

- Work with you to determine your coverage needs.

- Read the fine print for you and help you understand it.

- Review your coverage with you annually.

- Advise you in claims situations.

We create the right package for you, selecting from the best options from dozens of insurance providers. The end result is the peace of mind you need to focus on your business.

Having insurance coverage that is tailored to protect the business you have worked hard to create is important. Whether it’s your CRA Excise bond, specialized equipment coverage, or liability insurance to meet the requirements of a lease, we will provide the guidance you need so that you understand the options and how your risks are managed.

Why You Need to Secure Your Brewery or Distillery With Excise Tax Bonds

Cyber Liability Insurance for Brewers¶

No matter the size of your operation, effective IT security is crucial, our BrewAssure program provides cyber insurance specifically designed for craft brewers. This program ensures our clients receive preferred rates and comprehensive coverage.

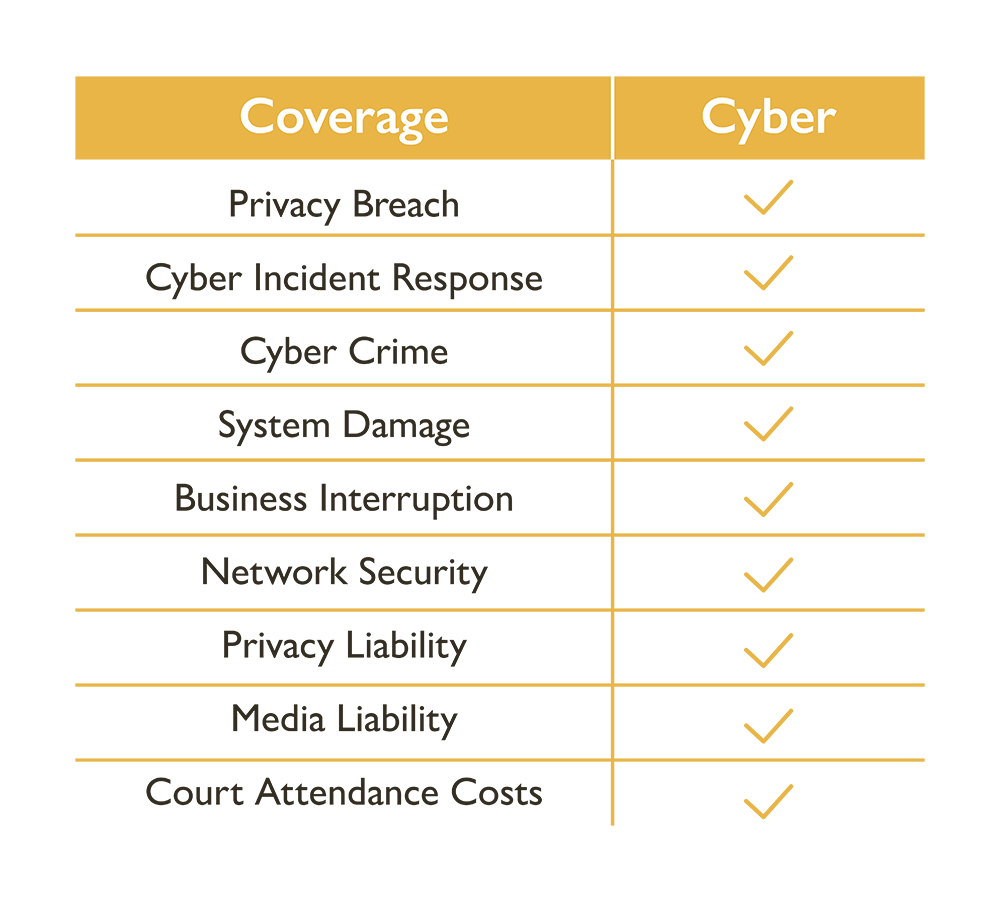

Coverage Highlights:¶

- Standard Coverage: $100,000 for Cyber and $50,000 for Cyber Crime, with higher limits available upon request.

Cyber Liability Insurance Coverage Highlights:¶

- Data Breach Response: Costs for notifying affected individuals, credit monitoring services, and public relations expenses.

- Cyber Extortion: Protection against ransomware attacks and extortion threats.

- Business Interruption: Coverage for income loss and additional expenses due to a cyber incident.

- Cyber Liability Legal Costs: Legal expenses related to regulatory investigations and lawsuits arising from a cyber incident.

- Reputational Harm: Assistance with public relations following a breach.

- Fines & Penalties: Coverage against financial penalties or regulatory fines resulting from a data breach or cyber incident.

Given the sensitive nature of information handled by breweries, robust cyber liability insurance, combined with a strong IT department, can significantly mitigate financial and reputational risks in the event of a cyber attack or data breach. In today’s digital landscape, protecting your brewery from cyber threats has never been more crucial. This need is underscored by mandatory breach notifications and the increasing frequency of cyber incidents within the industry.

Corporate Life Insurance¶

Corporate life insurance provides not only protection for the business should an owner, partner, or key employee pass on, it can help maximize the value of your financial assets.

Critical Illness Insurance¶

A major illness in a key team member can be devastating for your business. It can mean making a difficult choice between personal health and the health of the business.

That’s why the BrewAssure program offers critical illness coverage. In the event of cancer, heart attack, stroke, or other major illness, the coverage offers financial protection so that the business can keep going and your teammate can take the time they need to recover.

Business Owner Succession¶

While a craft brewery is a labour of love, most owners think about retiring at some point. We can help you understand which options are simply a smarter financial move, especially when it comes to taxation.

You’ve worked hard your whole life to build your business. We can help you protect it.

Attract and Keep Employees with Group Benefits¶

Your BrewAssure program can include attractive health care benefits like dental care and pharmaceutical coverage — whatever you and your employees want most.

BrewAssure’s health care benefits provide great buying power from partnering with hundreds of other companies, plus the flexibility to select the coverage type and amount that makes sense for your team.

Disability Insurance for Your Employees¶

Some disabilities, like a mental health condition or chronic pain that lingers after an injury, need the healing power of time. Disability insurance from BrewAssure can replace lost income for your team members, and can provide you with funds to hire a temporary replacement while they recover.